Just bought my first road tax this week and had a shock when i found how pricey it is- had to go for 6 months in the end which was £261.... Is that what everyones paying for a 2.5 T5??

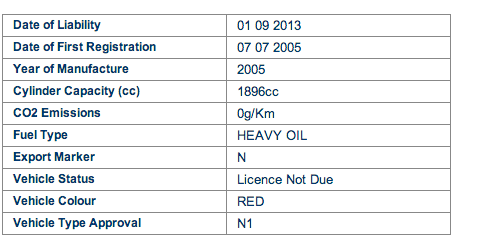

Am I right in think reclassifying as a camper will make no difference? Someone suggested a gadget to reduce CO2 emissions which apparently knocks tax down. Has anyone used one?

:*:*:*:*:*:*:*:*:*

Am I right in think reclassifying as a camper will make no difference? Someone suggested a gadget to reduce CO2 emissions which apparently knocks tax down. Has anyone used one?

:*:*:*:*:*:*:*:*:*